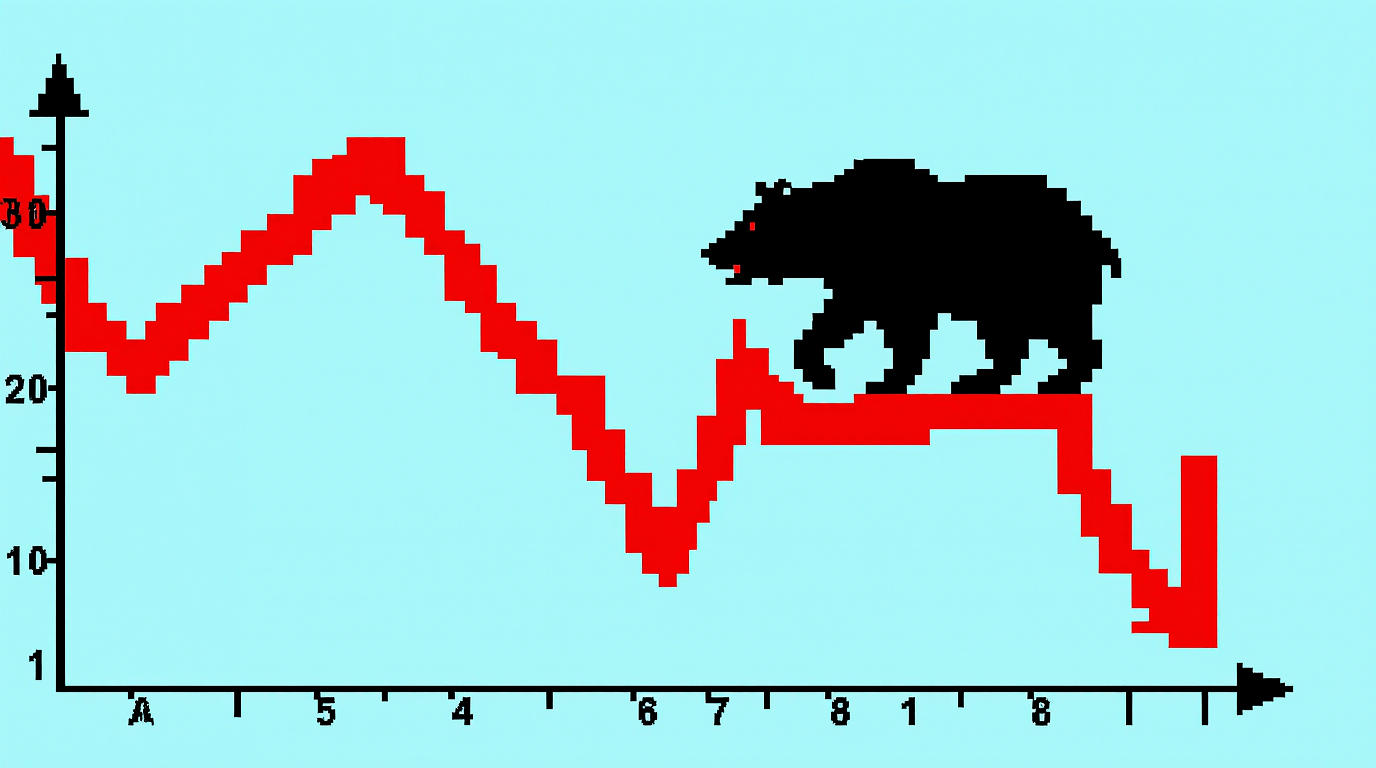

Picture this: You’re 28, checking your investment account during the 2022 market crash, watching your portfolio bleed red like a horror movie. Your stomach drops. Your friends are panicking. Your dad’s calling with “helpful” advice about pulling everything out.

But here’s what nobody tells you at that moment—you should be celebrating.

I know that sounds insane. Stick with me for five minutes, and I’ll show you why the math is brutally clear: if you’re under 40, market crashes aren’t your enemy. They’re your secret weapon.

The Uncomfortable Truth About Market Timing

Let’s start with an uncomfortable reality: You’re going to live through multiple market crashes. The average bear market (20%+ decline) happens every 3.5 years. Since 1950, we’ve had 14 bear markets. If you’re 25 today, you’ll likely experience 10-12 more crashes before you retire.

Here’s the kicker—most people get this completely backward. They think crashes are disasters that destroy wealth. But crashes don’t destroy wealth for long-term investors. They transfer it from the panicked to the patient.

Think of it like a fire sale at your favorite store. Everything’s 40% off, but instead of celebrating, everyone’s running away screaming because the building looks scary. Meanwhile, you’re calmly loading up your cart with designer goods at clearance prices.

The Dollar-Cost Averaging Superpower You Didn’t Know You Had

Here’s where the math gets beautiful. When you’re young, you’re not withdrawing money from investments—you’re adding to them. Every month, you’re pumping fresh dollars into your brokerage account through dollar-cost averaging.

During normal markets, your $500 monthly investment might buy you 10 shares of an index fund at $50 each. But during a crash? That same $500 suddenly buys you 20 shares at $25 each. You just doubled your share accumulation for the exact same dollar amount.

Let me paint you a picture with real numbers. During the 2008 financial crisis, the S&P 500 dropped 57% from peak to trough. If you kept investing $500 monthly through that crash, you accumulated shares at an average price that was roughly 30% lower than if you’d only invested during the bull market years.

The result? Those “disaster” investments became your highest-returning purchases when the market inevitably recovered.

The 20-Year Wealth Building Window

Here’s the harsh reality your financial advisor might sugarcoat: Time is your only true edge in investing. Not picking stocks, not timing the market, not following hot tips from Reddit. Just time.

If you’re 30 years old, you have roughly 35 years until retirement. That’s 35 years for compound growth to work its magic. And here’s the uncomfortable truth—the earlier those big gains happen in your investment timeline, the more they compound.

A 50% crash followed by a 100% recovery in your 30s will make you significantly wealthier than steady 8% annual returns with no volatility. Why? Because those extra shares you accumulated during the crash will compound for three decades.

The Retirement Reality Check

Here’s where this gets really interesting. Everything I just told you flips completely upside down as you approach retirement.

If you’re 60 and planning to retire at 65, a market crash isn’t a buying opportunity—it’s a genuine threat to your lifestyle. You don’t have 30 years to recover. You might need that money in 5-10 years, and sequence-of-returns risk becomes very real.

This is why target-date funds automatically shift from stocks to bonds as you age. It’s not because bonds are better investments—they’re not. It’s because when you’re older, preservation matters more than accumulation.

But right now, if you’re reading this and you’re under 40? Crashes are your friend.

The Psychology Trap That Destroys Wealth

The biggest enemy of young investors isn’t market crashes—it’s their own emotions. When markets drop 30%, the psychological urge to “do something” becomes overwhelming. The financial media amplifies the panic. Your brain, wired for survival, screams “DANGER!”

But here’s the brutal truth: Every study on investor behavior shows the same thing. The average investor underperforms the market by 3-4% annually, primarily due to buying high during euphoria and selling low during panic.

The investors who get rich aren’t the ones who avoid crashes. They’re the ones who stay calm during crashes while everyone else is losing their minds.

The Historical Playbook

Let’s look at history’s greatest hits of market disasters and what they meant for young investors:

The Dot-Com Crash (2000-2002): If you were 25 and kept investing through this 49% decline, those “disaster” purchases became the foundation of massive wealth as tech stocks exploded over the next two decades.

The Financial Crisis (2007-2009): Young investors who stayed the course through the 57% drop and kept buying didn’t just recover—they achieved life-changing returns as the market tripled from its lows.

The COVID Crash (March 2020): The fastest 34% decline in history became the setup for one of the strongest recoveries ever. Investors who bought during the panic saw their investments gain 50-100% in just two years.

The pattern is clear: Short-term pain, long-term gain. But only if you have the time horizon to wait it out.

Your Crash Action Plan

So what does this mean for you practically?

First, automate your investments so emotions can’t derail you. Set up automatic transfers to your investment accounts that continue regardless of market conditions.

Second, if you can stomach it, increase your investments during crashes. Not because you’re trying to time the bottom—that’s impossible. But because you mathematically know that buying more when prices are lower will improve your long-term returns.

Third, turn off the financial news during market crashes. It’s designed to grab attention through fear, not to help you make rational long-term decisions.

The Million-Dollar Mindset Shift

Here’s the mindset shift that separates wealth builders from wealth destroyers: Stop thinking about your portfolio’s current value and start thinking about the number of shares you own.

Your portfolio value will fluctuate wildly over the decades. But your share count only goes one direction—up—as long as you keep investing. And the cheaper you can buy those shares, the wealthier you’ll be in retirement.

When you’re 65, you won’t care that your portfolio was down 40% in 2035 or whenever the next crash hits. You’ll care that you accumulated an extra 10,000 shares during that crash that are now worth $50 each instead of $30.

The Bottom Line: Your Age Is Your Edge

If there’s one thing to remember from this entire article, it’s this: Your age is your greatest investment advantage, but only if you use it correctly.

Market crashes aren’t market failures—they’re market features. They separate the short-term speculators from the long-term wealth builders. They punish the panicked and reward the patient.

So the next time the market crashes 30% and everyone around you is freaking out, remember this article. Take a deep breath, check your age, and if you’re still decades away from retirement, allow yourself a small smile.

Your future self is about to get a lot wealthier, thanks to everyone else’s panic.

The crash isn’t happening to you—it’s happening for you.