When you hear the word “war,” you might imagine armies, tanks, or nuclear arsenals. But in today’s world, the real battlefield is inside factories producing semiconductor chips no bigger than a fingernail.

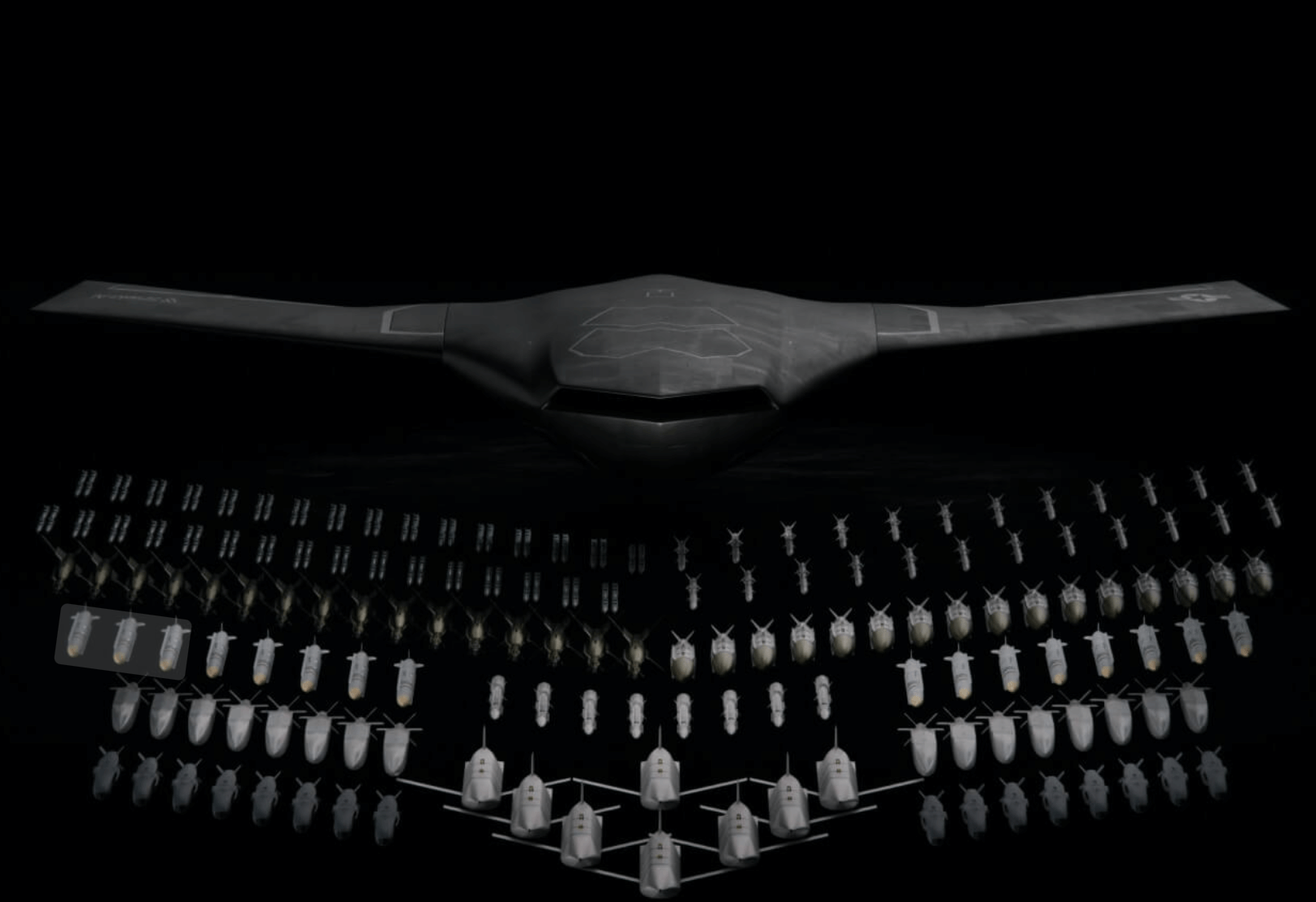

These chips run our phones, cars, fighter jets, artificial intelligence systems, and even nuclear defense shields.

The stakes are colossal: without semiconductors, the global economy would grind to a halt.

Think of semiconductors as the “brains” of modern civilization. Unlike oil in the 20th century, chips have become the essential resource defining power in the 21st century.

The Global Importance of Semiconductor Chips

The world semiconductor market was valued at over $630 billion in 2024 and is projected to cross $1 trillion by 2030 (Source: McKinsey). Growth is fueled by AI large language models, electric vehicles, 5G networks, cloud computing, military drones, and the Internet of Things. Every industry that matters in the digital age leans heavily on chips. The launch of AI-driven applications like ChatGPT immediately created a surge in demand for graphic processors and high-performance chips.

The truth is stark: without chips, modern life stops.

The Titans of the Semiconductor Industry

Taiwan Semiconductor Manufacturing Company (TSMC)

TSMC is the backbone of the global chip industry, producing over 55% of the world’s semiconductor foundry output and an astonishing 90% of the most advanced processors (Source: Boston Consulting Group). It is currently the only company capable of mass-producing 3nm chips and is already testing 2nm technology.

With clients like Apple, Nvidia, Qualcomm, and AMD, chances are your devices carry TSMC’s imprint. Yet its dominance comes with fragility — Taiwan’s geopolitical tensions make TSMC both the crown jewel and the Achilles heel of the digital economy.

Intel Corporation

For decades, Intel was the unrivaled leader in semiconductors until it lost ground in the 2010s. But the company is staging a comeback. With heavy backing under the US CHIPS Act, Intel is investing tens of billions into building advanced fabs in Ohio and Europe. This effort aims not only to regain technological leadership but also to reduce supply chain risks in a world where chip access is strategic leverage.

ASML: The Dutch Gatekeeper of Chipmaking

At the center of semiconductor progress lies ASML, a Dutch powerhouse few outside the industry recognize. Its exclusive extreme ultraviolet (EUV) lithography machines are essential to making chips at 5 nm and beyond. Each machine costs around $200 million and requires a logistical marvel to move. With its unrivaled monopoly, ASML controls one of the most strategic chokepoints in global technology.

The Equation of Power

TSMC delivers cutting-edge efficiency. Intel embodies resilience and diversification. ASML holds the keys to the entire kingdom. If TSMC is the chef and Intel the rival trying to reclaim the crown, ASML is the one selling the oven without which no dish can be made. Together, they define who gets a seat at the semiconductor table.

The Geopolitical Chessboard: US, China, and Taiwan

Semiconductors now shape foreign policy. The US sees China’s access to advanced chips as an existential challenge to its technological supremacy. In response, Washington has curbed exports of critical chipmaking tech to China, sanctioned certain Chinese companies, and incentivized domestic production through the $52 billion CHIPS and Science Act.

China, meanwhile, is investing hundreds of billions in its semiconductor industry but remains dependent on foreign designs, equipment, and tools. Taiwan remains the flashpoint. If the Taiwan Strait crisis escalates, global chip supply could be crippled overnight, sparking the greatest economic shock since World War II. The uncomfortable truth: a single island the size of Belgium holds the fate of global AI, cybersecurity, and defense systems.

The Global Supply Chain Web

Building a chip is not like assembling a car. It is a supply chain masterpiece.

- Design: Largely dominated by the USA (Nvidia, Qualcomm, Apple).

- Fabrication: Concentrated in East Asia (TSMC, Samsung).

- Equipment: ASML (Netherlands), Lam Research and Applied Materials (USA), Tokyo Electron (Japan).

- Materials: Japan and South Korea dominate photoresists and wafers.

- Assembly and Testing: Mostly done in Malaysia, Vietnam, and the Philippines.

This web of interdependence makes semiconductors both the world’s most impressive cooperative project — and its most volatile vulnerability.

The Environmental and Ethical Dimensions

Chip factories consume more water daily than large cities and devour massive amounts of electricity. Taiwan’s droughts in 2021 showcased how climate events can threaten global supply lines. Ethical concerns add more complexity. Export control regimes mean developing nations risk being locked out of advanced tech. Labor conditions in assembly hubs raise questions of fairness. And the carbon footprint of next-generation fabs clashes with global climate goals. Sustainable chips will be essential for a sustainable planet.

Conclusion: The New Strategic Frontier

From smartphones in your pocket to satellites orbiting Earth, every piece of technology depends on semiconductors. This isn’t just tech—it’s geopolitics, economics, and survival combined. In the industrial revolutions of the past, steel and oil determined power. In the digital era, chips play that role. They are no longer invisible parts of gadgets. They are the new frontline of global dominance.

The uncomfortable truth stands: the world’s future runs on silicon. Understanding this is not optional — it’s essential.