When people think of the world’s greatest stock market investors, legendary names like Warren Buffett and George Soros inevitably claim spotlight. But history holds another, rarely celebrated genius whose innovations transformed the very mechanics of trading—Richard Dennis. Dubbed “The Prince of the Pit,” Dennis quietly amassed a fortune in the commodities markets and changed investment history, all while avoiding the celebrity and adulation that shadows more iconic figures.

Born in a working-class Chicago neighborhood, Dennis developed an early fascination with odds and probability, gaining an intuitive understanding of risk that would later define his approach. His start was humbler than most: in the early 1970s, Dennis borrowed $1,600 to purchase a seat on the MidAmerica Commodity Exchange, a sum so small that even back then, traders scoffed. But Dennis was undeterred. Armed with a methodical, rule-based strategy—a rarity in times dominated by gut-driven speculation—he soon turned his modest stake into tens of millions of dollars.

Dennis didn’t just trade; he innovated. Most of Wall Street relied on analyst forecasts and insider tips, but Dennis believed in the power of price trends and human psychology. By studying technical signals and learning to “ride the waves,” he championed what’s now known as systematic, trend-following trading. His success was staggering: the profits from his trades in sugar, gold, and currencies often moved entire markets, earning him profits estimated at over $200 million by his mid-40s.

What separated Dennis wasn’t just performance—it was philosophy. He famously asserted that great traders could be made, not born. In 1983, he launched a radical social experiment with mathematician William Eckhardt, seeking to prove that ordinary people could learn his approach and excel. Dubbed “the Turtle Traders,” Dennis recruited and trained two groups of non-professionals, teaching them a precise set of rules for identifying breakouts, managing risk, and executing trades without emotions. The result? Within just four years, several “Turtles” had turned initial stakes into millions, and some went on to lead their own hedge funds.

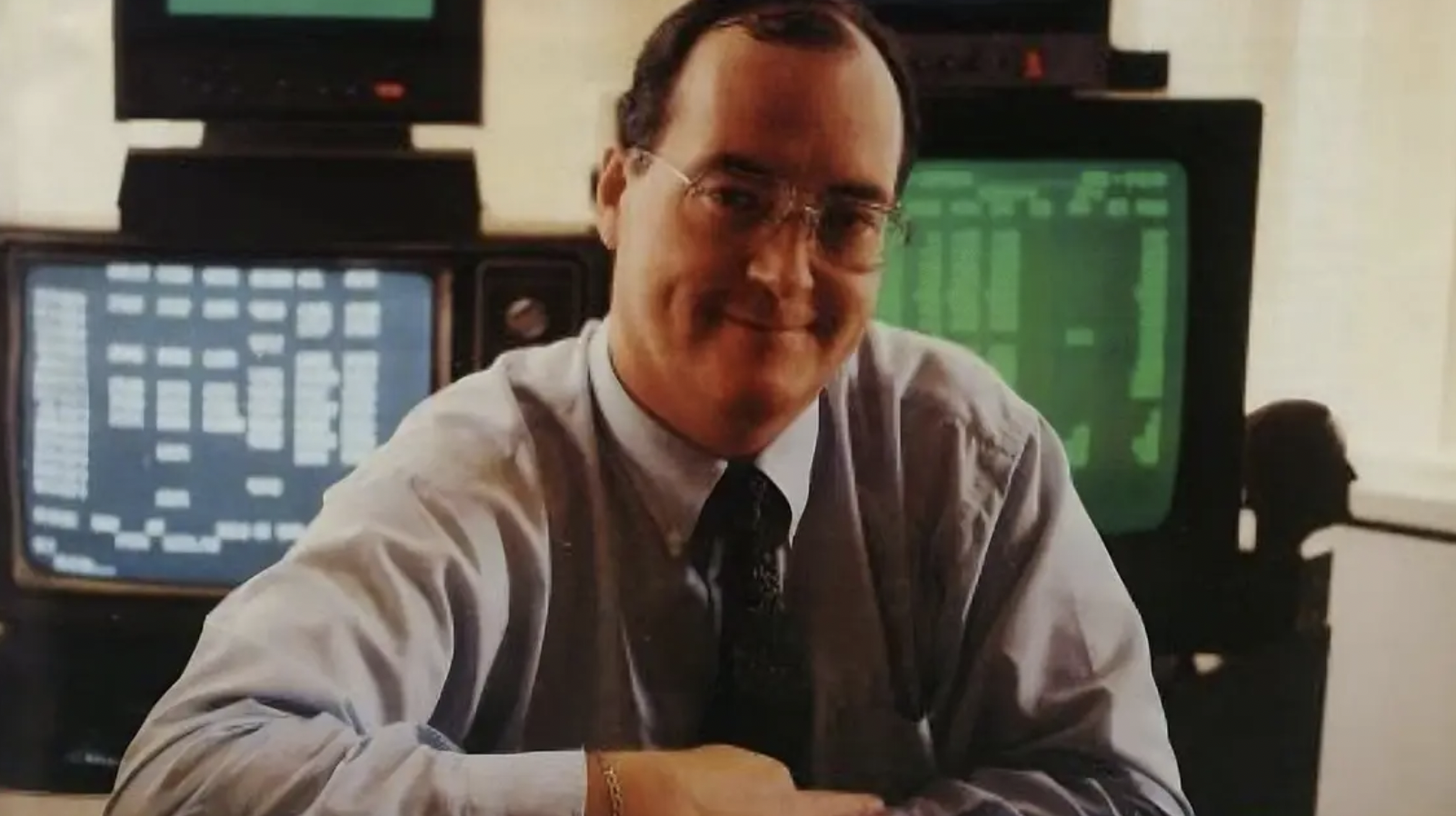

Unlike investment celebrities who relish the limelight, Dennis kept a low profile, shunning public attention. He rarely granted interviews, avoided mainstream media, and let his results—and his students—speak for themselves. Among traders and financial insiders, however, mention of Dennis elicited admiration bordering on reverence. His lessons live on in dozens of best-selling books and continue to shape quantitative finance, algorithmic trading, and even AI-powered models.

Richard Dennis’s achievements underscore a profound truth about markets: success comes not from following the crowd, but from having the discipline and courage to stick to tested principles. His method, grounded in statistical thinking and emotional control, has helped countless investors avoid catastrophic losses in turbulent times.

Dennis’s legacy also challenges our definitions of fame and greatness. While Buffett’s and Lynch’s fans watch annual shareholder meetings and quote their every word, Dennis’s influence can be seen in the nerves of millions of anonymous traders who program rules, adjust position sizes, and let patterns—rather than pundits—guide them. In truth, Dennis’s experiment laid the groundwork for democratizing trading strategies once reserved for the elite.

The story of the world’s greatest unknown investor offers inspiration well beyond financial success. It teaches that the marketplace always has room for new insight, that humility and innovation matter more than recognition, and that sometimes the most profound revolutions begin quietly outside the spotlight.

Today, Dennis’s “Turtle Rules” are public, dissected in trading classrooms and forums worldwide. But the spirit of his work—the appeal to critical thinking, patient discipline, and faith in ordinary people—remains as vital as ever. No matter the market climate, the lessons learned from Dennis’s invisible hand continue to echo in the halls of global finance.

For aspiring investors, Dennis’s career provides both blueprint and beacon: Start small, learn deeply, master discipline, and don’t be afraid to challenge assumptions. Genius may flourish in obscurity, but its impact, as Richard Dennis proved, can ripple through the very core of a global system.