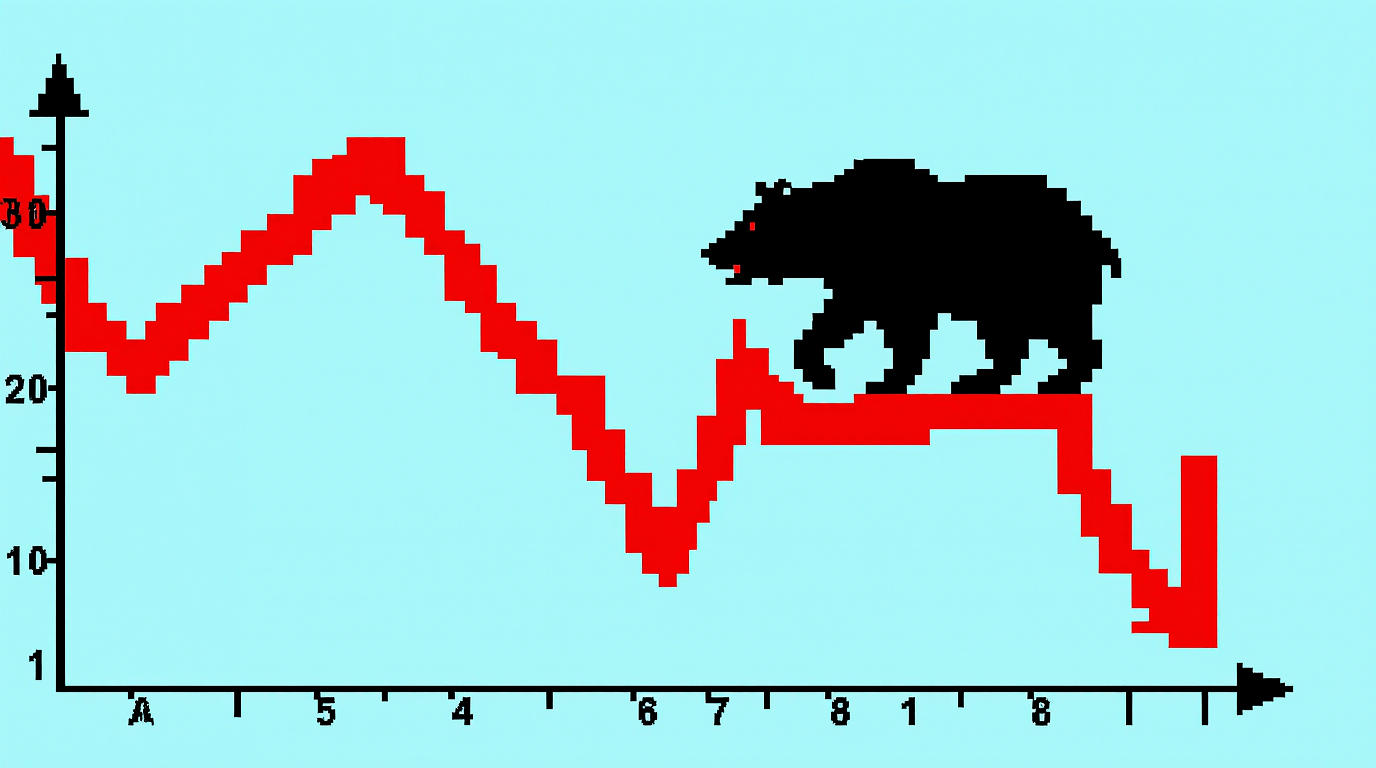

The Options Trading Epidemic: Why Retail Investors Are Getting Crushed

Retail options frenzy exploded 800% since 2019, with 0DTE contracts hitting $2T daily notional. Yet 90% lose money on average 5-14% per trade via bid-ask spreads, volatility mispricing, and holding losers. Robinhood profits $2B yearly from payment for order flow as casinos thrive on gamified gamblers.