Picture this: It is September 1929. Jazz fills the speakeasies, new automobiles gleam on city streets, and your neighbour—a factory worker—just made more in the stock market last month than he earns in a year. Everyone is getting rich. The Dow Jones has rocketed 600% in eight years. What could possibly go wrong?

Fast forward to today. Your phone pings with another market alert: the Dow just crossed 46,700. Another all-time high. AI stocks are soaring. Everyone is talking about ChatGPT like they once talked about Model T Fords. The champagne is flowing again.

But here is the thing that should make your stomach drop: We’ve seen this movie before. And it did not end well.

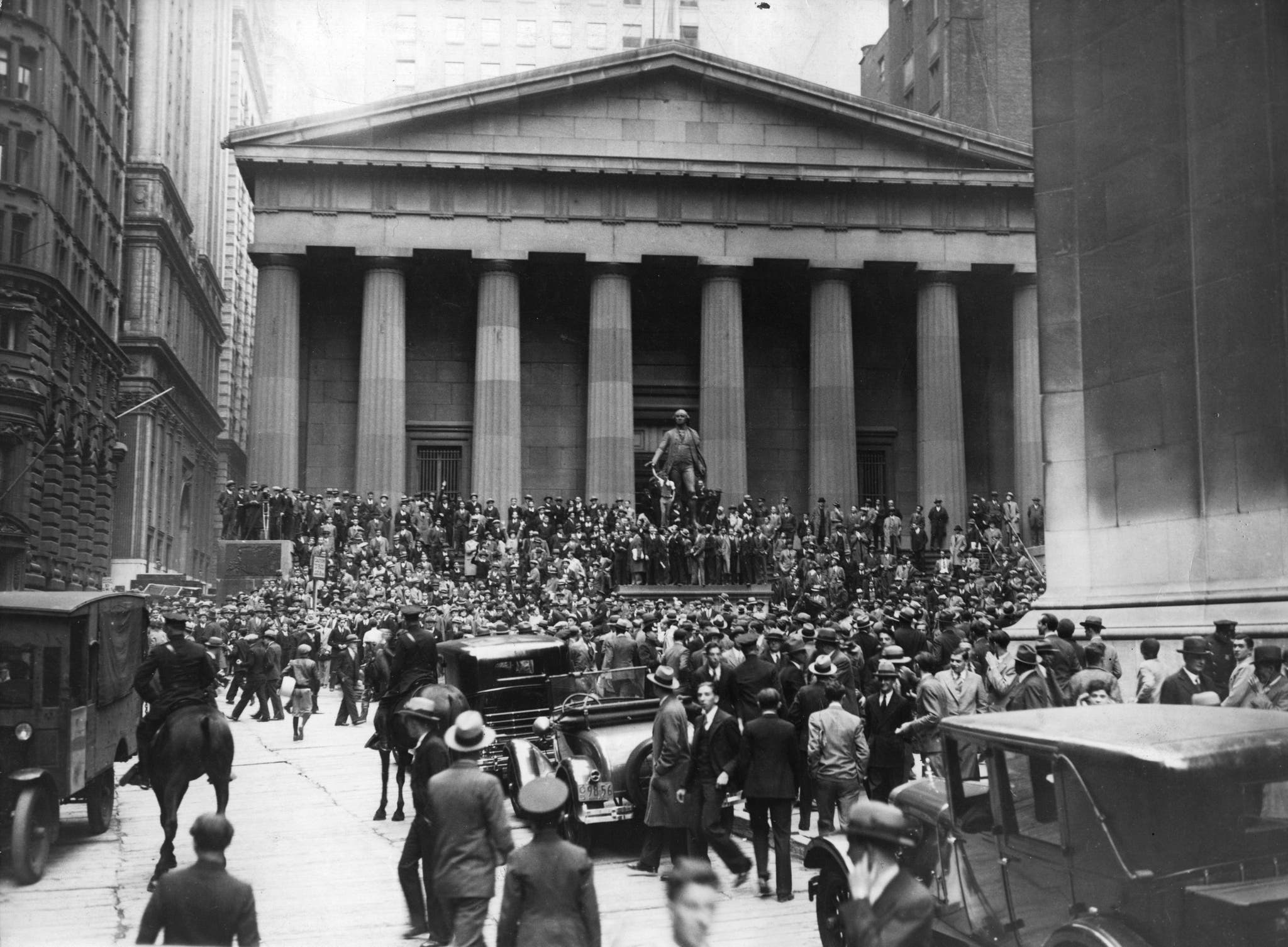

When the Music Stopped: The Crash That Changed Everything

Let us rewind to understand how spectacularly wrong things went in 1929.

Post-World War I America was electric with possibility. Factories roared to life, radios brought the world into living rooms, and automobiles transformed how people lived. The stock market became the nation’s obsession—not just for the wealthy, but for teachers, shopkeepers, and factory workers who borrowed heavily to buy stocks on margin.

The numbers tell a seductive story: from 1921 to 1929, the Dow exploded from below 70 to over 380. Ordinary Americans borrowed nearly 10% of the entire nation’s GDP to chase this dream. The legendary economist Irving Fisher looked at the soaring market and declared with absolute confidence: “Stock prices have reached what looks like a permanently high plateau.”

He said this in October 1929. Days before the crash.

When the music stopped, it stopped hard. The Dow plummeted 90% by 1932. Banks collapsed like dominoes. Unemployment shot past 20%. Families lost everything. The world plunged into the Great Depression—a decade-long nightmare that redefined what economic catastrophe looks like.

Today’s Rally: Same Song, Different Instruments

Now let us talk about right now—because the parallels are chilling.

Since 2009, we have witnessed one of history’s longest bull markets. Central banks slashed interest rates, pumped trillions into the economy, and transformed “recovery” into “boom.” Then came 2020—and instead of breaking the rally, the pandemic supercharged it. Stimulus checks, asset purchases, historic liquidity injections—the money printer went into overdrive.

The result? The Dow has surged from around 6,500 in 2009 to nearly 47,000 today. Another 600% explosion, matching the Roaring Twenties stride for stride.

Back then, it was radios and cars. Today, it is AI and quantum computing. The technology changes, but the psychology? Identical. We are convinced this time is different. That artificial intelligence will create infinite value. That markets have reached a “new normal” of permanently high returns.

Sound familiar?

The Warning Signs Are Flashing Red

Here is where it gets uncomfortable. Let us count the red flags:

The Debt Time Bomb: In the 1920s, households borrowed recklessly. Today, it’s governments. The U.S. national debt towers above $35 trillion—bigger than the entire economy. Interest payments alone are swelling toward record highs. Jamie Dimon, CEO of JPMorgan Chase, is not mincing words: “High valuations and rising leverage” could trigger a major market correction.

The Reality Gap: Stock prices are racing ahead while real economic growth crawls. We are not producing 600% more value than in 2009—we are just bidding up asset prices with borrowed money. Ray Dalio puts it bluntly: “When debt grows faster than income, the endgame is either default or devaluation.”

The Volatility Spikes: Remember when the Dow dropped 878 points in a single session recently? These sudden jolts are like tremors before an earthquake. The euphoria can evaporate in minutes.

The Most Disturbing Signal: When Everything Goes Up at Once

Here is something that should make every investor nervous: In 2025, gold, silver, AND stocks have all hit record highs simultaneously.

This is rare. Extremely rare. And deeply unsettling.

Why? Because these assets traditionally move in opposite directions. Stocks rise when investors feel confident about the economy. Gold and silver rally when people are scared—seeking safe havens from chaos, inflation, and collapse.

When they all surge together, it means the market is schizophrenic. Investors are simultaneously euphoric about AI profits and terrified of what is coming. They are betting on boom and hedging for doom at the same time.

This is not confidence. It is confusion masquerading as conviction. It is everyone at the party sensing something is wrong but too afraid to leave first.

“In 1929 Andrew Ross Sorkin brings the drama of the crash to a high pitch. He has consulted weather reports, diaries, architectural records and every newspaper imaginable to create a vivid and historically accurate account of the boom, crash, and aftermath.” – The Wall Street Journal

The Global Powder Keg: More Connected, More Dangerous

The 1929 crash sent shockwaves worldwide, but in slow motion—news traveled by telegraph, markets closed for days at a time, and global trade moved by ship.

Today? When Wall Street sneezes, Tokyo, London, and Mumbai catch pneumonia in milliseconds.

We are more interconnected than ever, which means we’re more fragile than ever:

- U.S.-China tensions turn every tech stock and tariff announcement into a market-moving event

- Wars in Europe and the Middle East send energy prices—and inflation fears—spiking

- Global debt exceeds $320 trillion—a number so large it defies comprehension

- De-globalization accelerates as countries weaponize trade, hoard resources, and erect barriers

And here is the kicker: In 2025, new tariffs on Chinese imports and strategic goods have already triggered market selloffs and recession fears. We are watching protectionism—the same poison that turned the 1929 crash into the Great Depression—make its comeback tour.

The 1930s taught us that when nations turn inward, everyone loses. We are flirting with that mistake again.

The Psychology of Bubbles: Why Smart People Make Dumb Bets

Economics is not just mathematics—it’s human nature. And human nature has not changed since 1929.

In bull markets, optimism becomes a virus. Success breeds confidence, confidence breeds risk-taking, and risk-taking feels like genius—until it doesn’t. In 1929, seemingly rational people convinced themselves that old rules no longer applied. The market could only go up.

Today, we hear the same refrains:

- “AI will revolutionize everything”

- “Central banks won’t let markets crash”

- “This time is different”

But here is the terrifying truth: The herd mentality that powered the 1920s is now amplified by algorithms, social media, and 24/7 trading. When panic strikes, it moves at the speed of light, not telegraph cables. The crash, when it comes, could make 1929 look slow.

The Question That Keeps Economists Awake

So, are we headed for a repeat of 1929?

The honest answer: We don’t know. But we are certainly testing the same limits—unchecked optimism, unprecedented leverage, structural imbalances papered over with hope and liquidity.

The good news? We have tools the 1920s did not. Better financial regulations. Deposit insurance. Central banks that understand their role. Global coordination mechanisms. Real-time data. The ability to learn from history.

The bad news? We also have tools to make things worse. Algorithmic trading that amplifies panic. Social media that spreads fear instantly. Political polarization that prevents coordinated responses. And most dangerously, the hubris that comes from thinking we have outsmarted history.

What History Is Trying to Tell Us

The Great Depression was not caused by a single bad day in October 1929. It was the inevitable result of years of unchecked optimism, rising leverage, and ignoring structural imbalances.

We are seeing those same ingredients today—record highs built on record debt, real economic fragility masked by financial market strength, and a collective refusal to acknowledge that gravity still exists.

But we still have time. We still have choices. We can demand better regulation, insist on fiscal responsibility, diversify our risks, and most importantly, remember that markets can’t defy fundamentals forever.

Mark Twain supposedly said, “History doesn’t repeat itself, but it often rhymes.”

Right now, in 2025, we are listening to a rhyme that sounds uncomfortably familiar. The question is: Will we change the ending, or will we insist on performing the same tragedy while convinced we are writing a different play?

The orchestra is playing. The champagne is flowing. The market is soaring.

But if you listen carefully beneath the celebration, you might hear an echo from 1929—a whisper asking if we’re about to learn that history’s most expensive lessons are the ones we refuse to remember.