Here’s the uncomfortable truth your financial advisor won’t tell you about Bitcoin’s current valuation

Key Takeaways

• Institutional demand has surpassed Bitcoin mining supply by 5.6x in 2025

• 83% of institutional investors plan to increase crypto allocations this year

• Bitcoin ETFs are creating unprecedented accessibility for traditional investors

• Supply shock dynamics make current $116K price mathematically undervalued

• Nation-states are shifting from regulation concerns to strategic Bitcoin adoption

The Wake-Up Call That’s Making Wall Street Nervous

You’ve probably seen the headlines screaming about Bitcoin hitting $116,000, and if you’re like most people, you’re thinking one of two things: either “I missed the boat” or “this bubble is about to burst.” Here’s the kicker – both assumptions are dead wrong.

While retail investors are busy debating whether Bitcoin is overpriced, institutional giants are quietly doing math that would make your calculator smoke. The result? What looks like an astronomical price today is actually Bitcoin trading at a massive discount to its fundamental value.

Think of it this way: when Amazon was trading at $400 per share in 2016, critics called it overvalued. Today, after stock splits, that same investment is worth over $3,000. The difference? Institutional investors understood Amazon’s true value proposition while retail investors focused on sticker shock.

The same pattern is playing out with Bitcoin right now, but at warp speed.

The Institutional Avalanche You’re Not Seeing

Here’s what’s happening behind closed doors while you’re watching price charts: 83% of institutional investors plan to increase crypto allocations in 2025, with 59% intending to allocate over 5% of assets under management to digital assets.

Let’s put that in perspective. When a pension fund with $50 billion decides to allocate just 2% to Bitcoin, that’s $1 billion flowing into an asset with a fixed supply cap. Now multiply that across thousands of institutions globally.

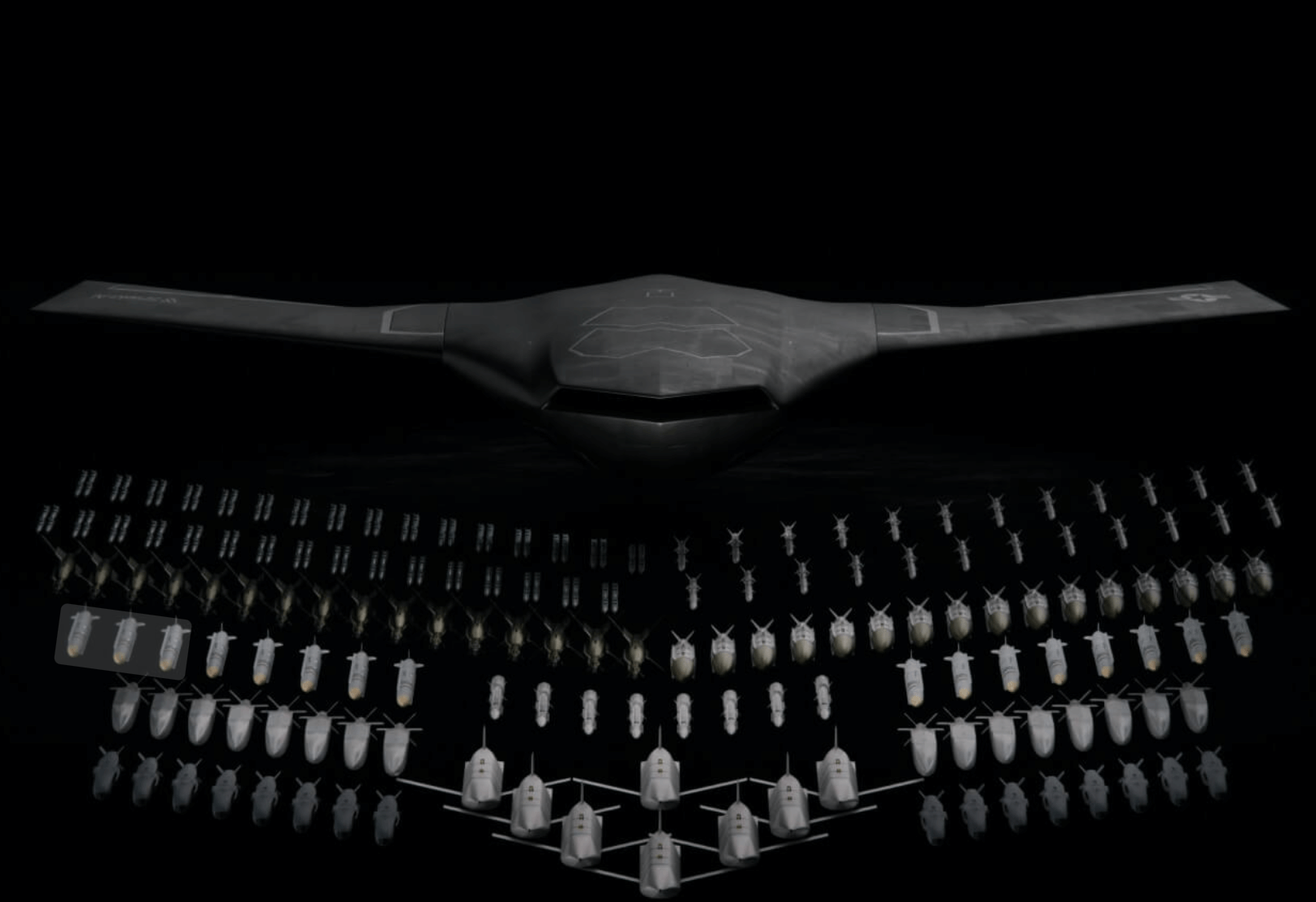

The uncomfortable truth? Institutional Bitcoin demand has already surpassed new mining supply by 5.6x in 2025. We’re not just talking about high demand – we’re witnessing a supply shock that most retail investors haven’t even recognized yet.

It’s like watching a game of musical chairs where there are 100 players but only 10 chairs, and most people are still standing around wondering when the music will start.

The $200K Math That Wall Street Banks Are Betting On

The Scarcity Multiplier Effect: Bitcoin’s total addressable market isn’t just individual investors anymore. When sovereign wealth funds, central banks, and Fortune 500 companies start treating Bitcoin as a treasury asset, you’re looking at a completely different demand equation.

Consider this analogy: imagine if every major corporation suddenly decided they needed to own a piece of Manhattan real estate. The total supply of Manhattan isn’t increasing, but the pool of qualified buyers just exploded. That’s essentially what’s happening with Bitcoin’s fixed 21 million coin supply.

The Network Effect Acceleration: Max Keiser predicts Bitcoin to be worth $200K in 2024, while Fidelity predicts one Bitcoin will be worth $1B by 2038. These aren’t moonshot predictions – they’re mathematical projections based on adoption curves and monetary policy trends.

The ETF Game-Changer That’s Rewriting the Rules

Remember when your grandmother could only buy stocks by calling a broker? ETFs changed everything by making institutional-grade investments accessible to everyone. Bitcoin ETFs are doing the same thing, but with a twist that makes the opportunity even more compelling.

BlackRock’s IBIT ETF attracted $91.5 million in a single day, and this is just the beginning. When traditional investors can buy Bitcoin through their existing brokerage accounts with the same ease as buying Apple stock, the floodgates open.

Here’s the kicker: unlike traditional assets where increased demand can be met with increased supply (companies can issue more shares, countries can print more bonds), Bitcoin’s supply is algorithmically fixed. Every dollar of new demand pushes against an immovable supply ceiling.

The Supply Shock Reality Check

Bitcoin reached its highest price of $124,517 on August 14, 2025, but here’s what most people missed during that surge: it wasn’t driven by retail FOMO – it was institutional accumulation hitting critical mass.

The Mining Economics: After the 2024 halving, Bitcoin miners now produce roughly 450 coins per day. At current institutional demand levels, that’s like trying to fill a swimming pool with a garden hose while someone else is draining it with a fire truck.

The HODLer Effect: Long-term holders – both retail and institutional – continue removing Bitcoin from circulating supply. It’s not just about new demand; it’s about existing supply becoming increasingly illiquid.

Think of it like this: if every art collector in the world suddenly wanted to own a Picasso, but 80% of existing Picasso owners refused to sell, what would happen to prices? That’s the Bitcoin market in 2025.

The Regulatory Tailwind That Changes Everything

President Trump’s actions that are good for cryptocurrencies continue to give digital assets regulatory optimism. But this isn’t just about one administration – it’s about a fundamental shift in how governments view Bitcoin.

The Strategic Reserve Narrative: When nation-states start viewing Bitcoin as a strategic asset rather than a speculative toy, the entire valuation framework changes. Institutional and sovereign accumulation can significantly influence price trajectories.

We’re moving from “Will Bitcoin be regulated?” to “How can we position ourselves advantageously within the new Bitcoin-integrated financial system?”

The $200K+ Target Isn’t Fantasy – It’s Mathematics

Analysts are forecasting potential price targets that range from $200,000 to $300,000, and when you understand the underlying drivers, these numbers start looking conservative rather than optimistic.

The Portfolio Allocation Math: If just 1% of global investable assets flow into Bitcoin, you’re looking at roughly $3 trillion in potential demand against a maximum supply worth approximately $2.5 trillion at current prices. The math is simple: something has to give, and it won’t be the supply.

The Institutional FOMO Factor: Companies continue to add Bitcoin to their balance sheet, and once this trend reaches critical mass, late-adopting institutions will face a painful choice: buy Bitcoin at much higher prices or explain to stakeholders why they missed the boat.

The Bottom Line: Why $116K Is Just the Warm-Up Act

While everyone’s focused on Bitcoin’s price volatility, institutional investors are playing a completely different game. They’re not trying to time the market – they’re positioning for a fundamental shift in how value is stored and transferred globally.

BlackRock’s head of digital assets suggests that Bitcoin’s price will soon match up with growing institutional adoption. When the world’s largest asset manager starts talking about price-adoption alignment, you’re witnessing the early stages of a paradigm shift, not a speculative bubble.

The reality check? At $116K, Bitcoin is pricing in current demand while ignoring the institutional tsunami that’s already building. When that wave hits full force, today’s “high” prices will look like the early bird special.

The question isn’t whether Bitcoin will reach $200K+ – it’s whether you’ll position yourself before the rest of the market wakes up to the math that Wall Street is already calculating behind closed doors.